Accounting

71 account. 71 accounting accounts

Last modified: 2025-06-01 07:06

Information article on the need for proper documentation of business transactions for the issuance of funds under the report on travel expenses and business needs

Accounting for cash transactions. Basic concepts

Last modified: 2025-01-24 13:01

Every organization, regardless of its size, in the course of carrying out activities of almost any kind, is faced with the need to use cash. And if, as a rule, non-cash payments are used to pay for the necessary materials or ordered services, then payment for travel and some other expenses occurs with the help of cash

Accounting for working hours in the summary accounting. Summarized accounting of the working time of drivers with a shift schedule. Overtime hours with summarized accounting of wor

Last modified: 2025-01-24 13:01

The Labor Code provides for work with a summarized accounting of working hours. In practice, not all enterprises use this assumption. As a rule, this is due to certain difficulties in the calculation

Net profit formula - calculation

Last modified: 2025-01-24 13:01

For any businessman or individual entrepreneur, profit is important. It is the result that is the cause of any business. To calculate the indicator, the net profit formula is used. After reading the article, everyone will be able to understand what this coefficient is and how to find it

Forensic accounting expertise: main goals and objectives

Last modified: 2025-01-24 13:01

In the event of various conflict situations, without which it is difficult to imagine economic activity, accounting expertise can correct the state of affairs. This is a separate study conducted by qualified specialists, the purpose of which is to find out the real state of affairs in the organization

Modern currency relations

Last modified: 2025-01-24 13:01

As the world economy globalizes and internationalizes, international flows of goods, capital, services and loans are growing. Currency relations are social interactions that accompany the implementation of operations related to the functioning of currencies in the course of the interstate exchange of goods, services and information

Federal Law "On Accounting" No. 402-FZ of December 6, 2011, as amended and supplemented

Last modified: 2025-01-24 13:01

402-FZ establishes uniform requirements for reporting. They are obligatory for implementation by all entities carrying out entrepreneurial activities, if it is specified in the provisions of the law

Work in progress in accounting at the enterprise

Last modified: 2025-01-24 13:01

What is work in progress? How are the concepts of work in progress and finished goods related? Why is the correct organization of WIP accounting at the enterprise so important? These and other questions will be discussed in our article

Estimated cost - what is it?

Last modified: 2025-01-24 13:01

An investment project is calculated for each stage of construction work. It describes in detail all the materials, work and their pricing necessary for the construction of the building. This detailed calculation has its own name - the estimated cost of construction

Advance report: postings in 1C. Advance report: accounting entries

Last modified: 2025-01-24 13:01

Article on the rules for compiling advance reports, accounting entries reflecting transactions for the purchase of goods and services for cash, as well as travel expenses in the accounting of the enterprise

Declaration 4-personal income tax. Form 4-NDFL

Last modified: 2025-01-24 13:01

Form 4-NDFL is submitted by individual entrepreneurs using OSNO. The document is executed after receiving the first profit in the reporting period from the moment of switching to the main mode

Advance report is Advance report: sample filling

Last modified: 2025-01-24 13:01

Expense report is a document that confirms the expenditure of funds issued to accountable employees. It is drawn up by the recipient of money and submitted to the accounting department for verification

When to take SZV-STAGE? New reporting to the FIU

Last modified: 2025-01-24 13:01

All employers must annually submit Information on the insurance period of insured persons (SZV-STAGE). For more information on how to prepare, where and when to submit a report, read on

Deadline for the payment of insurance premiums. Completing insurance premiums

Last modified: 2025-06-01 07:06

The essence of the calculation of insurance premiums. When and where do I need to submit the RSV report. The procedure and features of filling out the report. Deadlines for submission to the Federal Tax Service. Situations when settlement is considered not submitted

How to stitch a book (cash or income) with your own hands

Last modified: 2025-01-24 13:01

The article describes why you need to stitch the cash book and income book. How books are kept, how the process of stitching takes place

Sample explanatory note to the tax office on demand, detailed instructions for compiling

Last modified: 2025-01-24 13:01

The article describes the answers to the requirements of the tax office, depending on the nature of the request

How to calculate piecework wages: formula, examples

Last modified: 2025-06-01 07:06

Within the framework of this article, the basics of determining and calculating piecework wages will be considered. Formulas and examples for calculating amounts are given

UIP - what is it in a payment order? Unique payment identifier

Last modified: 2025-01-24 13:01

Since 2014, the UIP is an important requisite that must be filled in if it is provided by the seller, and also if this identifier should be considered as a UIN when it is indicated in payment documents for paying fines, pen alties for taxes and fees . This code is indicated in the field of the payment order at number 22. It can be filled in both manually and using special software tools, the main of which is "1C: Enterprise"

How sick leave is paid: features, requirements and calculation

Last modified: 2025-01-24 13:01

Sick leave is a document by which you can receive money. For this, it is provided to the accounting department. It makes sense to independently check your accruals and payments. So, a lot depends on the length of service and the amount of wages for the previous two years

Tax burden: calculation formula. Instructions, features, examples

Last modified: 2025-06-01 07:06

As part of this article, the concept of the tax burden of an enterprise in modern conditions will be considered, as well as methods for calculating it for various taxes

44 accounting account is Analytical accounting for account 44

Last modified: 2025-06-01 07:06

44 accounting account is an article designed to summarize information about the costs arising from the sale of goods, services, works. In the plan, it is, in fact, called "Sales Expenses"

Accounting. Accounting for cash and settlements

Last modified: 2025-01-24 13:01

Accounting for cash and settlements at the enterprise is aimed at ensuring the safety of capital and controlling its use for its intended purpose. The efficiency of the company depends on its proper organization

How is the piece rate determined? Piece rate is

Last modified: 2025-01-24 13:01

One of the key organizational issues at the enterprise is the choice of the form of remuneration. In most cases, employees of enterprises receive remuneration in accordance with their salary and hours worked. However, this scheme can not be applied in all organizations

Accounting: accounting for fixed assets under the simplified tax system

Last modified: 2025-06-01 07:06

Accounting for fixed assets under the simplified tax system is used to reduce the taxable base. However, this is not always possible. The fact is that there are two versions of a simplified system

WACC: formula, balance calculation example

Last modified: 2025-06-01 07:06

As part of this article, a general idea and concept of the value of WACC (weighted average cost of capital) is considered, the main formula for calculating this indicator is presented, as well as an example of calculation using the presented formula

Re-sorting of goods is a simultaneous shortage of one item of goods and a surplus of another. Accounting for sorting during inventory

Last modified: 2025-06-01 07:06

When conducting an inventory at trading enterprises, shortages, surpluses, and regrading are often revealed. With the first two phenomena, everything is more or less clear: there is either a lot of this or that product, or a little. Re-sorting of goods is a rather unpleasant and difficult situation

Write-off of marriage: documents, reflection in accounting. Reasons for marriage

Last modified: 2025-01-24 13:01

No matter how hard a manufacturer strives to meet standards, some products are produced with defects. Such products are called marriage. The reasons for its appearance are very different: the human factor, equipment failure, etc. In any case, defective products should not be delivered to the consumer

Is it necessary to take a zero 6-personal income tax: features, requirements and reviews

Last modified: 2025-01-24 13:01

Form 6-NDFL, introduced by the tax service last year, still raises questions. Especially a lot of controversy arises around the zero report

Accounting accountant job description: sample

Last modified: 2025-01-24 13:01

The main terms of reference of an employee are established by the job description approved by the management of the enterprise. In this article, we will consider the main approaches to compiling the job description of an accountant for settlements with suppliers

Decreasing depreciation balance method: example, calculation formula, pros and cons

Last modified: 2025-01-24 13:01

Depreciation charges are one of the most important accounting processes in an enterprise. Depreciation, one way or another, is charged by all enterprises, regardless of the taxation system that they use

Materials released to production (posting). Accounting for the disposal of materials. accounting entries

Last modified: 2025-06-01 07:06

Most of all existing enterprises can not do without inventories used to produce products, provide services or perform work. Since inventories are the most liquid assets of the enterprise, their correct accounting is extremely important

Losses - what is it?

Last modified: 2025-01-24 13:01

What are losses? When do they occur? How can you fight them? What are their types?

Organization of accounting: basic principles, features and requirements

Last modified: 2025-01-24 13:01

Control is almost always the key to good luck. And if we talk about accounting for the activities of the organization, then there is no way to do without it. How to implement it? What are the nuances of the organization of accounting and reporting in practice? What to focus on, so as not to make a mistake and not be guilty before the state?

Accounting financial accounting in the organization

Last modified: 2025-01-24 13:01

What is financial accounting? Methods for improving the efficiency of financial accounting. Why is financial accounting necessary?

Retirement of fixed assets

Last modified: 2025-01-24 13:01

The write-off of fixed assets in organizations is carried out almost daily. In order to avoid problems from the regulatory authorities in the future, the procedure must be carried out and executed correctly

How to draw up the forecast balance of the enterprise?

Last modified: 2025-01-24 13:01

Along with the balance sheet, many enterprises also form a forecast balance. What is its purpose? How is the balance sheet drawn up?

Accounting in budgetary organizations and not only in them

Last modified: 2025-01-24 13:01

In this article, accounting is seen not just as a boring money counting system, but as a total way to control the values of the entire civilization

Accounting for intangible assets in accounting: features, requirements and classification

Last modified: 2025-01-24 13:01

Intangible assets of the organization are formed and accounted for in accordance with applicable law. There is an established methodology by which legal entities reflect this property in the accounting documentation. There are several groups of intangible assets. Features of accounting for such property, the basic norms established by law, will be discussed in the article

Accounting policy PBU: application and general position

Last modified: 2025-01-24 13:01

Russian firms conduct accounting policies within the framework of accounting rules or RAS due to legal requirements, as well as due to the need to solve various business problems. What is the specificity of the accounting policy for PBU in the Russian Federation? What sources of law govern it?

Formula for calculating vacation days. Duration of annual basic paid leave

Last modified: 2025-06-01 07:06

Vacation is a long-awaited period. However, despite the fact that the number of days is established by law, there are always some nuances

Rules for maintaining a work book in Russia

Last modified: 2025-01-24 13:01

Russian employers should start work books for their employees. These are the provisions of the law. What is the specifics of the work of companies with work books provided for by law?

VAT on advances received: postings, examples

Last modified: 2025-06-01 07:06

When transferring amounts for future deliveries, the seller must issue an invoice. The buyer can deduct the tax without waiting for the sale. This amendment to the Code was created in order to reduce the tax burden. How is VAT deducted from advances received in practice?

Accounting for settlements with different creditors and debtors, accounting account. Settlements with suppliers and contractors

Last modified: 2025-01-24 13:01

In the process of carrying out business transactions, it becomes necessary to make settlements with other debtors and creditors. In the chart of accounts, the account is used to summarize such information. 76. It reflects a debit or credit debt that arises in the process of mutual settlements with other legal entities that are not included in the settlement accounting registers

What is a pen alty? Pen alty: definition, types, features and accrual procedure

Last modified: 2025-01-24 13:01

In case of violation of contractual obligations, Russian legislation provides for a special type of pen alties. Such a concept as a pen alty serves as a regulator of compliance with the deadlines for the transfer of tax payments, utilities and many other obligations

Storno is a corrected bug

Last modified: 2025-01-24 13:01

In accounting, there is such a thing as reversal. Such an operation is quite often used in practice and is important in correcting various digital values

To help an accountant: submission of reports in electronic form

Last modified: 2025-01-24 13:01

In order to reduce the burden during the reporting period, the tax authorities strongly recommend switching to electronic filing of declarations. This method significantly saves taxpayers time and greatly simplifies the reconciliation of necessary payments and charges

Getting acquainted with the RSV form, what is the Unified calculation

Last modified: 2025-01-24 13:01

Report on the accrued contributions to the Pension Fund must all legal entities and individual entrepreneurs that pay salaries to staff. For this purpose, the Foundation has developed a specialized form of RSV-1. Entrepreneurs submit a calculation regardless of the chosen tax regime

Payroll Accountant Job Description: Duties, Rights and Responsibilities

Last modified: 2025-01-24 13:01

When accepting an employee who will carry out the calculation and calculation of wages, you should study the candidate as carefully as possible. Documenting responsibilities with the help of job descriptions will help to avoid many controversial situations

62 account for buyers and customers

Last modified: 2025-01-24 13:01

62 account is an analytical registry for working with buyers and customers. Its registers help to most accurately reflect business transactions related to cash receipts

Management of accounts receivable of the organization

Last modified: 2025-01-24 13:01

Receivables management allows you to see the weaknesses of the organization, evaluate the effectiveness of its credit policy, and also predict the flow of future funds to the company's account

How to calculate average earnings for a business trip and vacation pay

Last modified: 2025-01-24 13:01

How to pay for the days spent by an employee on a business trip? This is a problem that a beginner accountant will undoubtedly face. Which is easier than giving him a regular salary, because he worked all this time for the enterprise. But everything related to labor relations is subsequently subjected to a painstaking check by regulatory authorities

What is accounts receivable and how to work with it

Last modified: 2025-01-24 13:01

Organizations or individual entrepreneurs with a non-cash payment system are often perplexed: “What is it: receivables are getting bigger every month, growing like a snowball?” Someone will say that this is good - products (services) are in demand, and with the calculation you can wait a while. But do not flatter yourself - basically, such an increase is a signal that the company will incur losses in the near future. Have you ever thought that some permanent debtors use you as a bank?

What is a debit? Accounting debit. What does account debit mean?

Last modified: 2025-01-24 13:01

Without knowing it, we are exposed daily, even at a basic level, to the basics of accounting. At the same time, the main concepts with which a person deals are the terms "debit" and "credit". Our compatriots are more or less familiar with the last definition. But what is a debit, not everyone represents. Let's try to understand this term in more detail

The deadline for transferring personal income tax from vacation pay

Last modified: 2025-01-24 13:01

In 2015, changes were made to the Tax Code of the Russian Federation regarding the timing of payment of personal income tax. They entered into force on January 1, 2016. What is the deadline for transferring personal income tax from salaries and other income?

Restoration of accounting and reporting by a third party

Last modified: 2025-01-24 13:01

Sometimes restoring accounting and reporting on your own is almost impossible or can take too long. In such cases, you will have to turn to professionals who have the skills to perform this work

Types of accounting. Types of accounting accounts. Types of accounting systems

Last modified: 2025-01-24 13:01

Accounting is an indispensable process in terms of building an effective management and financial policy for most enterprises. What are its features?

Financial liabilities: analysis, structure. Passives are

Last modified: 2025-01-24 13:01

Liabilities are operations that form bank resources. For every commercial institution, they are very important. First, the bank's reliability factors are the stability of resources, their structure and size. Secondly, the price of resources also affects the amount of profit. Thirdly, the cash base determines the volume of active operations that generate income for the bank

What is "Score 20". Account 20 - "Main production"

Last modified: 2025-01-24 13:01

Commercial enterprises are created with the aim of obtaining the maximum amount of profit. For this, various types of economic activity are used, for example, wholesale and retail trade in purchased goods, the provision of services, and own production. Depending on the chosen field of activity, a system for maintaining all types of accounting is selected

Direct costs are an important part of investment accounting

Last modified: 2025-01-24 13:01

All costs of the enterprise can be divided into several areas, which differ depending on the intentions of using the information received. According to the first, the results of the economic activity of the organization can be identified by the impact on the established cost of production. Distinguish between indirect and direct costs

Payroll formula: example

Last modified: 2025-01-24 13:01

Payroll depends on the payment systems adopted at the enterprise, which are fixed by regulatory local acts. In the employment contract concluded between the employer and the employee, the form of work and the payment system must be prescribed, indicating the tariff rate or the established salary for each specific case

Calculation of average earnings for an employment center: formula, rules, sample

Last modified: 2025-01-24 13:01

Help to the employment center for the payment of unemployment benefits: who issues the necessary information, sample filling. Rules for calculating average earnings for an employment center. Features of calculating the average earnings for three months

Vacation pay: how to reflect in 6-personal income tax, sample filling

Last modified: 2025-01-24 13:01

Vacation pay: how to reflect the payment and deduction of personal income tax in 6-personal income tax. Filling in the lines in the second section of the 6-NDFL form. Examples of filling out 6-NDFL: December, June vacation pay, rollover vacation pay

Recovery of accounting through outsourcing

Last modified: 2025-01-24 13:01

Today, many young managers who have started their own business do not have sufficient experience in personnel management. Even if the workflow can be established independently, non-executive or inexperienced staff will cause many problems. Restoration of accounting, ongoing management of the enterprise, consulting services in accordance with applicable law - only a small part of the privileges that a business owner will receive by signing an agreement with an outsourcing agency

Order journal. Filling out magazines-orders. Account journals

Last modified: 2025-01-24 13:01

Each company has the opportunity to independently choose the system and form of tax and accounting. The prevailing principles for the formation of accounting data are: reliability, transparency, accessibility of perception, the possibility of obtaining a report on any asset or type of settlement, exclusion of data leakage and distortion

Paying overtime is an important point in the workflow

Last modified: 2025-01-24 13:01

Overtime pay is in the form of extra pay for extra hours worked. However, it has its own characteristics. The total amount of overtime worked can only be accurately known at the end of the accounting period

Standard personal income tax deductions for children

Last modified: 2025-01-24 13:01

Individual income tax is mandatory removed from each officially working citizen. However, many are en titled to deductions that allow you to pay taxes not on the entire amount, but only on part of it

Quick liquidity ratio: balance sheet formula. Solvency indicators

Last modified: 2025-01-24 13:01

One of the signs of the company's financial stability is solvency. If the company can pay off its short-term obligations at any time with the help of cash resources, it is considered solvent

Normative value of return on sales by industry

Last modified: 2025-01-24 13:01

Calculation of the standard value of return on sales for industrial enterprises and other organizations is extremely important in the management of the company. Knowing these indicators, it is possible to conduct a qualitative economic analysis and improve the efficiency of the enterprise

Account register is a way of processing data

Last modified: 2025-01-24 13:01

Accounting register - these are specific accounting tables that have a certain form. They can be built as a result of the economic grouping of data on property owned by an enterprise or organization, as well as on the sources of investment of similar accounting items

How to draw up an advance report? Pattern and rules

Last modified: 2025-01-24 13:01

Expense report is the primary document in accounting workflow. Its main purpose is to confirm the amount spent by the accountable person

Vendor invoice accepted for goods received: posting with VAT

Last modified: 2025-06-01 07:06

The vast majority of all existing enterprises, both large and small, cannot do their business without suppliers. This article will define what an acceptance is, consider the types of acceptances in accounting, types of transactions, accounts for settlements with suppliers, unified forms of primary documents for settlements with suppliers, postings and examples

Revaluation of non-current assets. Line 1340 of the balance sheet

Last modified: 2025-06-01 07:06

In a market economy, prices for various goods that an enterprise can purchase for economic activity are constantly changing. The purchase price of an item of fixed assets in the current year may differ significantly from that for which this item was purchased. The company can track changes in prices for those objects of property that it has, make a special recalculation of the cost for them and take into account the difference

Accounting for beginners: from postings to balance. Accounting

Last modified: 2025-01-24 13:01

Accounting is quite complex, but at the same time necessary. What does he represent? Why should this be studied? What are the nuances? Let's look at accounting for beginners from postings to balance

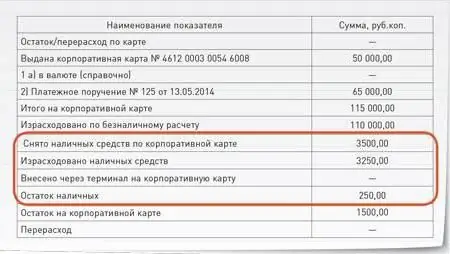

Corporate card report: example. Accounting for a corporate bank card

Last modified: 2025-01-24 13:01

Accounting for corporate cards is quite simple. Experienced accountants, as a rule, do not have any problems recording transactions. Difficulties may arise when compiling a report on a corporate card by an employee to whom it was issued

Cash and cash equivalents: the meaning of the concept, structure and presentation in reporting

Last modified: 2025-01-24 13:01

Many novice accountants are not completely clear what is included in the concept that we will analyze in the article, how it is characterized, how to display it in the ledger. Therefore, we will try to describe in detail what cash and cash equivalents are. At the end of the article, we will also give an algorithm for their presentation in accounting documents

Tangible non-current assets in the company's balance sheet

Last modified: 2025-06-01 07:06

Small businesses often use simplified reporting forms when compiling a balance sheet. The abbreviated form consists of five asset lines and six liabilities. It would seem that balancing would be very simple. In practice, accountants have to face a number of difficulties. Consider the algorithm for compiling an abbreviated balance sheet with the presence of tangible non-current assets

How child support is calculated. Formula and example for calculating child support for one and two children

Last modified: 2025-01-24 13:01

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated

Methodology for calculating lease payments

Last modified: 2025-06-01 07:06

The word "leasing" has English roots. Translated, the term means "rent". Leasing is a type of financial services, a specific form of lending for the acquisition of fixed assets by enterprises or expensive goods by individuals

Inventory is Definition, essence and features

Last modified: 2025-01-24 13:01

Raw materials taken from natural conditions undergo various types of processing before they reach the final consumer in the form of a finished product. It is moved, combined with other materials. Moving along the chain, raw materials are delayed from time to time, waiting for the turn to enter the next stage of the life cycle

Additional wages are The concept, components, calculation procedure

Last modified: 2025-01-24 13:01

Salary is divided into basic and additional. Each type has its own characteristics. It is also worth knowing which species are included in a particular list

Accounting and tax accounting at a manufacturing enterprise: definition, maintenance procedure. Normative accounting documents

Last modified: 2025-01-24 13:01

In accordance with PBU 18/02, since 2003, the accounting should reflect the amounts arising from the discrepancy between accounting and tax accounting. At manufacturing enterprises, this requirement is quite difficult to fulfill. The problems are related to the difference in the rules for valuation of finished goods and WIP (work in progress)

Accounting for corporate cards: payment procedure

Last modified: 2025-01-24 13:01

Bank corporate cards are versatile. That is why calculations with them are widely used today. Corporate cards are convenient to use on business trips of employees both within the country and abroad, when paying for representative services, receiving cash at points of issue and ATMs

How is vacation pay calculated? Calculation examples

Last modified: 2025-01-24 13:01

The article describes the features of the calculation of vacation funds. The main examples of how you can independently calculate how much the employer must pay are considered

1C: Enterprise 8. 1C-Logistics: Transportation Management (description and features)

Last modified: 2025-01-24 13:01

Logistics is a process of managing human, information and material flows based on cost minimization. To improve its efficiency, many enterprises use the software product "1C: Enterprise 8. TMS Logistics. Transportation Management"

Depreciation premium - what is it?

Last modified: 2025-06-01 07:06

Almost every enterprise has fixed assets (OS). They have a tendency to wear out. According to PBU rules, fixed assets are recorded, and depreciation is charged on them

Spend authorization - what is it?

Last modified: 2025-06-01 07:06

Approval of expenses of budgetary organizations involves the establishment and bringing limits of obligations, control and accounting for their acceptance. It is necessary in order to prevent the assumption of obligations that are not secured by appointments determined by budgetary legislation

The Chart of Accounts is Instructions for using the Chart of Accounts

Last modified: 2025-01-24 13:01

Chart of accounts is an integral part of the accountant of any organization. It is noteworthy that in some cases an enterprise may use accounts that are not included in the main document. But mostly accounts are used that are spelled out in the work plan of the organization

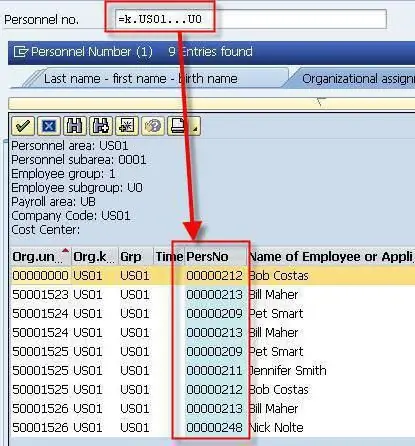

Employee personnel number: how is it assigned? Why do you need a payroll number?

Last modified: 2025-01-24 13:01

Personnel number is a concept not familiar to everyone. However, most employees have it. Some employees of the personnel department have difficulty thinking about how to correctly assign this number. However, there are no difficulties in this operation

How to count vacation? How to correctly calculate the period of vacation

Last modified: 2025-01-24 13:01

How to properly calculate your vacation in different situations? Read all the details in this article

Electronic document management between organizations: how does it work?

Last modified: 2025-01-24 13:01

Electronic document management is a fast way to exchange information based on the use of electronic documents with virtual signatures. It has long won recognition in the developed countries of the world as an effective tool for operational business management

How to calculate the cost-effectiveness of the proposed activities?

Last modified: 2025-06-01 07:06

To determine how effectively the funds were invested, it is necessary to calculate the economic efficiency of the proposed activities

How to fill out the journal of the cashier-operator correctly: sample and basic rules

Last modified: 2025-01-24 13:01

Roles and tasks of the cash journal. Basic rules for filling and registration of KM-4. The main requirements for the title page of the book of the cashier-operator. Journal replacement rules. Columns of the KM-4 form, instructions for filling them out. Journal entry template. Features when returning goods, acquiring

Basic methods of financial analysis: description, features and requirements

Last modified: 2025-01-24 13:01

How can you assess the position of the enterprise? Only to analyze his cases on the basis of available data. This is the discipline of financial analysis. It allows you to carefully evaluate the available data and make your own verdict. The tools in this process are the methods of financial analysis. What are they? What goals are suitable for?

Accounts receivable and accounts payable is The ratio of accounts receivable to accounts payable. Inventory of receivables and payables

Last modified: 2025-01-24 13:01

In the modern world, various accounting items occupy a special place in the management of any enterprise. The material presented below discusses in detail the debt obligations under the name "receivables and payables"

The balance sheet is the main source of information about the state of the enterprise

Last modified: 2025-01-24 13:01

The balance sheet is one of the main forms (form No. 1) of the annual reporting of enterprises. It must be compiled by all organizations that are on the general taxation system. Visually, it is a table that reflects the sources of funds formation: own and borrowed (liability), as well as directions of use (asset)

Inventory - what is it? Goals, methods and types of inventory

Last modified: 2025-01-24 13:01

Inventory is an inventory of property designed to identify discrepancies between the actual number of valuables and the information contained in the company's internal documentation. The article lists the main varieties of such a check. The procedure for conducting an inventory is given

On the importance of the ability to correctly calculate sick leave

Last modified: 2025-01-24 13:01

Calculation of sick leave at the enterprise is performed by an accountant. This work requires perseverance, close attention, as well as knowledge of the constantly changing laws and regulations in force in the country

Accounting and auditing are important management functions

Last modified: 2025-01-24 13:01

Accounting and auditing are important management functions, as well as a means of solving problems of both economic and social development of the enterprise and the country as a whole. These concepts should be provided both by the management of the organization and by the relevant services in all industries

Formula for calculating turnover and examples

Last modified: 2025-06-01 07:06

One of the indicators that characterizes the dynamics of the company's sales is turnover. It is calculated in selling prices. Analysis of the turnover gives an assessment of the qualitative and quantitative indicators of work in the current period. The validity of calculations for future periods depends on the conclusions made. Let us consider in more detail the methods for calculating turnover

Balance: types of balance. Types of balance sheet

Last modified: 2025-01-24 13:01

The balance sheet is the most important accounting document of an institution. What is it, what are the rules for filling it out, types and classification